The Challenge:

The Challenge:

The General Tax Directorate, under the direction of Ministry of Finance, manages the activity of thousands of tax payers all over Albania. The General Tax Directorate needed a system encompassing all Albanian entities subject to tax paying that would allow efficient risk analysis. They needed detailed, standardized information that would allow them to follow the activity of all tax-payers. Identifying the risk subjects with high accuracy, on time, relying on many different sources was the main challenge of this system. High level of security was another must of this challenge. The system asked for analytical expertise including complex scoring analysis and final evaluation.

The Solution:

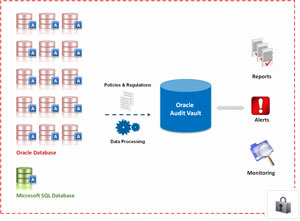

Konsort introduced and developed Risk Analysis System. The system is based on a centralized Oracle database that is fed automatically by an ETL engine. This system analyzes all information related to Albanian Tax Payers, extracted from all possible tax systems that apply respectively.

The system automatically collects data of the tax payer activity. Based on more than 70 criteria the system compares the progress of a subject in relation to its historical activity and in relation to other subjects of the same industry. It scores the result and shares it periodically in the form of lists. The lists are detailed and updated. The system offers availability and promptness. Through an alerting method, the users are continually kept to date.

The system encompassed the supervision of a key, sensitive concept of General Tax Directorate, risk subjects. Konsort used its rigorous methodology to analyze and develop the system. It accomplished the challenge concluding the project in two months and integrating existent resources with the new system. The process was accompanied by a close collaboration with General Tax Directorate involved departments.

The Result:

With an innovation in public sector’s technological advancements, General Tax Directorate possesses since 2009 a contemporary Risk Analysis System. The automating of risk analysis process is translated in efficiency, accuracy and improved decision making. The process of risk analysis is more transparent. The 24/7 surveillance and the alerting mechanisms have resulted in real time responses. The system has induced excellent, fast, improved service. The reporting and analytical tools available have stimulated information completeness, improved important prediction and increased state revenue.

With an innovation in public sector’s technological advancements, General Tax Directorate possesses since 2009 a contemporary Risk Analysis System. The automating of risk analysis process is translated in efficiency, accuracy and improved decision making. The process of risk analysis is more transparent. The 24/7 surveillance and the alerting mechanisms have resulted in real time responses. The system has induced excellent, fast, improved service. The reporting and analytical tools available have stimulated information completeness, improved important prediction and increased state revenue.